BUSINESS STUDIES

PAPER 2

TIME: 2 HOURS.

Instructions to candidates

- Answer any five questions

-

- Describe the channels of distribution for imported manufactures goods (10marks)

- Explain five characteristics of good money (10marks)

-

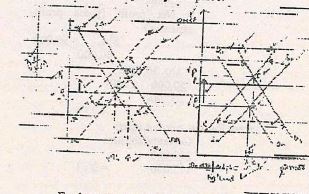

- Using graphical illustration, show the effects of an increase in demand accompanied by a decrease in supply on equilibrium price and quantity (10mark)

- Explain five disadvantages of using pipeline as a means of transport (10marks)

-

- A country intends to use the expenditure approach to measure her National Income. Explain Five problems encountered when using this method (10marks)

- Explain five differences between endowment policy and whole life policy (10marks)

-

- Explain five benefits of economic liberalization to Kenya (10marks)

- Explain five internal factors that may positively affect the operations of a business (10marks)

-

- The following account balances were extracted from the books of Gucci Traders on 30th June 2010

Calculate:Shs Opening stock 120,000 Purchases 170,000 Returns inwards 30,000 Closing stock 110,000 Sales 300,000 Creditors 115,000 Discount allowed 40,000 Capital 200,000 - Gross profit margin (3marks)

- Rate of return on capital (3 marks)

- Current ratio (3marks)

- Highlight the significance of each of the above ratios to a business (3marks)

- Explain four implications of a population structure and size on the development of a country 8marks)

- The following account balances were extracted from the books of Gucci Traders on 30th June 2010

-

- Explain five principles which guide the government in its expenditure allocation (10marks)

- On 15 July 2009, Kamau stores showed the following balances:

Cash in hand kshs 20,000

Cash at Bank kshs 8,600 (cr)

During the month, the following transactions took place;- 3/07/09 Jane, a debtor settled her account of kshs. 16,000 by cheque of kshs. 15,000

- 6/07/09 paid rent by cash kshs. 800

- 10/07/09 deposited kshs. 6,000 into the business bank account from cash till

- 15/07/09 settled Musa's account of kshs. 20,000 and allowed a discount of 1%

- 18/07/09 deposited kshs. 28,000 in the bank from private resources

- 21/07/09 Cash sales kshs. 12,000

- 24/07/09 Otieno debtor settled his account by cheque of kshs. 8,000 having been allowed a discount of 20%

- 26/07/09 purchased furniture of kshs. 5,200 paying by cheque

- 28/07/09 Received kshs. 3,600 cash from SIALO

- 30/07/09 banked the available cash except kshs. 1,600

Required

Prepare a three column cash book duly balanced (10marks)

MARKING SCHEME

-

- Five channels of distribution for imported manufactured goods

- foreign producer/ manufacturer → Local agent → local wholesaler → local retailer → local consumer

- foreign producer/ manufacturer → local wholesaler → local retailer → local consumer

- foreign producer/ manufacturer → local manufacturers representative → wholesaler → retailer → local consumer

- foreign producer/ manufacturer → local wholesaler → local consumer

- foreign producer/ manufacturer → local consumer

- Five characteristics of good money include:

- Acceptability : money should be acceptable to all as a medium of exchange

- Durability: money should be made up of materials that last long. It is expensive to continue minting coins and paper money

- Divisibility: money should be easily divisible into small denominations but still maintain its value

- Cognizabllity money should be made out of special material and have features that make it casily recognizable

- Homogeneity: should be made of identical material. This eliminates confusion and forgeries

- Portability: It should be convenient to carry especially in cases where the money has a high face value.

- Scarcity: It should be scarce so as to maintain its value

- Liquidity: It should be easily convertible to other forms of wealth.

- Five channels of distribution for imported manufactured goods

-

- Show effect of an increase in demand accompanied by a decrease in supply on equilibrium quantity and price.

- Explanation text

The initial output OQ0 = DDo = SSo

Initial price OP0

Equilibrium E0

Changes in quantity/ output due to increase in dd and decrease in supply

Output/quantity increases from 0Q0 to OQ1

OQ1 - DD1 = SS1

Prince increases from OP0 - OP1

New equilibrium (OQ1 = DD1 = SS1) at E1

Nb: If diagram is wrong, no marks for text

- Explanation text

- Disadvantages of using pipeline as a means of transport include;

- Initial capital: initial cost of construction is high in terms of financial resources and technical know-how

- Not flexible: since once a line is laid cannot be adjusted thus cannot be used to serve other areas unless expanded

- Capital intensive: thus does not generate employment opportunities

- Limited products: only a small range of products can be transported through a pipeline

- One way: transport of goods in one way since there is no return journey

- Ownership: owned by a specific company therefore its use is restricted to that company unlike roads which are public

- Supplementing they need to be supplemented with tankers since on their own they can't access various products to every town

- Show effect of an increase in demand accompanied by a decrease in supply on equilibrium quantity and price.

-

- Problems encountered in using expenditure approach method of measuring national income include;

- Lack of accurate data of expenditure especially in the private sector/informal sector

- Measuring the expenditure for the subsistence sector is very difficult

- Double counting arise out of unclear area of expenditure

- Changes in exchange rate make it difficult to calculate net expenditure from international trade

- Differentiating between expenditure on final goods and intermediate good is a problem

- Estimating depreciation is not easy and accurate

- It is not easy to get accurate figures on peoples' expenditures

- Differences between endowment policy and whole life policy

Endowment policy Whole life policy Premiums are paid over an agreed period of time by the assured Premiums are paid by the assured person throughout lifetime until death Sum assured/compensation is paid at the end of the agreed period to the assured if alive or to beneficiary if assured dies before maturity date Sum assured is payable only if the death of assured occurs hence compensation to the nominated beneficiary/next of kin Is a type of savings/financial security with profit/bonus paid at the end of period agreed /expiry date This policy aims at providing compensation/financial security to the beneficiary of the assured The assured can obtain loan/credit from the insurer/financial institution using the policy as a collateral Whole life policy cannot serve as security for loan to the assured Endowment policy holder enjoys income tax relief based on total amount of premiums payable yearly There is no tax relief on this policy If maturity of the policy comes before death, sum payable to the assured serves as financial security at retirement age Sum payable compensation serves as security to dependants of the assured After payment of certain number of minimum premiums, the assured can voluntarily terminate the policy and get a refund on proportion of money paid hence surrender value In case of termination of paying premiums, no surrender value can be paid as it is a breach of contract - NB: To qualify for a mark differences must tally. No splitting

- Problems encountered in using expenditure approach method of measuring national income include;

- Benefits of economic liberalization to Kenya include:

- Consumers can access variety of goods/services, producers gets competitive price/wider market/world wide market

- Less documentation /bureaucracy in foreign trade

- Steady supply/avert shortage due to trade barrier removal

- Competitive prices operates/no price regulation/ increase free trade

- Increased capital flow/human resource investments

- Increased flow of communication/research information/ industry, technology/free trade regulations requirements/change in policy etc

- Greater ease and relatively fast/speed in transportation in

- Competition keeps prices relatively low lessens inflation negative effects

- Inter cultural exchange/mingling /understanding for peaceful trade

- Steady cash flow into developed countries e.g. china, India in Africa/decrease currency differences/exchange rates fluctuations

NB: splitting [2x5=10marks]

- Internal factors that may positively affect the operations of a business include:

- Objectives: Setting business objectives which are achievable and realistic

- Financial and physical resources: a business should be able to combine a variety of resources such as finances and equipment in appropriate proportions/ quantities to be able to run successfully

- Personnel knowledge, skills and values: management should ensure that the people hired to work have the necessary knowledge and skills for their job

- Organisation culture: management should ensure that there is a strong and dynamic culture in order to enhance a strong relationship within the organisation

- Management policies and styles: if business policies are clear and there is participatory management style, then the firm is likely to succeed in adopting any changes within the organisation

- Communication management should ensure that there is effective communication flow within and without the organization

- Benefits of economic liberalization to Kenya include:

-

- Gross profit margins

- Cost of sales= opening stock+ purchases - closing stock

= 120,000+ 170,000 - 110,000 - shs 180,000

Net sales= sales - returns inwards

= 300,000 - 30,000 = shs. 270,000

Gross profit = net sales - cost of sales

= 270,000 - 180,000 = shs.90, 000

Margin = Gross profit x 100% =

Net sales

= 90,000 x 100

270,000

= 33.3% - Return on capital = Net profit x 100

Capital

= Net profit [gross profit - expenses]

Shs 90,000 - 40,000 = shs 50,000

50,000 x 100

200,000

= 25% - Current Ratio = current assets

Current liabilities

230,000

115,000

= 2:1 - Significance of the above ratios

- Gross profit margin

- Gross profit ratio may be indicated to what extent the selling prices of goods per unit may be reduced without incurring losses on operations.

- It reflects efficiency with which a firm produces its products. As the gross profit is found by deducting cost of goods sold from net sales, higher the gross profit better it is.

- There is no standard GP ratio for evaluation. It may vary from business to business. However, the gross profit earned should be sufficient to recover all operating expenses

- Rate of return on capital

- Is considered to be the best measure of profitability in order to assess the overall performance of the business.

- It indicates how well the management has used the investment made by owners and creditors into the business.

- It is commonly used as a basis for various managerial decisions. As the primary objective of business is to earn profit, higher the return on capital employed, the more efficient the firm is in using its funds.

- The ratio can be found for a number of years so as to find a trend as to whether the profitability of the company is improving or otherwise

- Current ratio

- This ratio is a general and quick measure of liquidity of a firm.

- It represents the margin of safety or cushion available to the creditors. It is an index of the firm's financial stability.

- It is also an index of technical solvency and an index of the strength of working capital.

- A relatively high current ratio is an indication that the firm is liquid and has the ability to pay its current obligations in time and when they become due.

- On the other hand, a relatively low current ratio represents that the liquidity position of the firm is not good and the firm shall not be able to pay its current liabilities in time without facing difficulties

- An increase in the current ratio represents improvement in the liquidity position of the firm while a decrease in the current ratio represents that there has been deterioration in the liquidity position of the firm.

- A ratio equal to or near 2:1 is considered as a standard or normal or satisfactory. The idea of having doubled the current assets as compared to current liabilities is to provide for the delays and losses in the realization of current assets. However, the rule of 2:1 should not be blindly used while making interpretation of the ratio. Firms having less than 2:1 ratio may be having a better liquidity than even firms having more than 2:1 ratio. This is because of the reason that current ratio measures the quantity of the current assets and not the quality of the current assets.

- If a firm's current assets include debtors which are not recoverable or stocks which are slowmoving or obsolete, the current ratio may be high but it does not represent a good liquidity position.

- Gross profit margin

- Cost of sales= opening stock+ purchases - closing stock

- Implications of a population structure and size on the development of a country include;

- Decline in per capita income: High population growth results into a decline in the per capita income when there is no proportionate growth in a capital formation

- Low standards of living: Since high population growth reduces per capita income, the standards of living will be equally low

- High dependency ratio:High rate of population growth implies high level of investment to achieve a given income per capita, young and ageing population increase consumption and resources are diverted to more consumption and less savings

- High unemployment rates: A rapid increasing population creates unemployment in a country

- Limited provision of social infrastructure: a rapidly growing population necessitates large investment in social infrastructure such as health, education and clean water and diverts resources from direct productive assets

- Insufficient labour: slow growing population lacks adequate labour to exploit all its resources

- Land pressure and its fragmentation

- Dependency level

- Gross profit margins

-

- Principles that guide the government in its expenditure allocation;

- Maximum social benefit: it should provide maximum benefit to majority of the target groups e.g. social services like education, health and housing should benefit everybody regardiess of their locality

- Economy of expenditure: there should be no wastage i.e. government resources should be used economically

- Authority: expenditure should be approved by the relevant authority e.g. parliament in Kenya

- Elasticity: this is the case with which government expenditure can be expanded or be Teduced e.g. during emergencies such as drought, expenditure should be increased towards purchase of relief food, and be reduced when the drought period is over

- Productivity: major proportion of government expenditure should be spent on development projects, to ensure that production is increased.

- Principles that guide the government in its expenditure allocation;

KAMAU STORES

THREE COLUMN CASH BOOK

FOR MONTH OF JULY 2009

| Date July 2009 |

Details | Discount Allowed (Ksh) |

Cash (Ksh) |

Bank (Ksh) |

Date July 2009 |

Details | Discount Received |

Cash (Ksh) |

Bank (Ksh) |

| 1/7/09 | Bal b/d | 20,000 | 1/7/09 | Bal b/d | |||||

| 3/7/09 | Jane | 1,000 | 15,000 | 6/7/09 | Rent | 8,000 | |||

| 10/7/09 | Cash (c) | 6,000 | 10/7/09 | Bank (c) | 6,000 | ||||

| 18/7/09 | Capital | 28,000 | 15/7/09 | Musa | 200 | 19,800 | |||

| 21/7/09 | Sales | 12,000 | 26/7/09 | Furniture | 5,200 | ||||

| 24/7/09 | Otieno | 2,000 | 8,000 | ||||||

| 28/7/09 | Sialo | 3,600 | |||||||

| 30/7/09 | Cash (c) | 27,200 | 30/7/09 | Bank(c) | 27,200 | ||||

| 31/7/09 | Bal c/d | 1,600 | |||||||

| 31/7/09 | Bal c/d | 2,800 | 50,600 | ||||||

| 3,000 | 35,600 | 84,200 | 3,000 | 35,600 | 84,200 |

Nb: if details are wrong. No mark for amount

Alternative B

KAMAU STORES

THREE COLUMN CASH BOOK

Dr Cr

| Date July 2009 |

Details | Discount Allowed (Ksh) |

Cash (Ksh) |

Bank (Ksh) |

Date July 2009 |

Details | Discount Received |

Cash (Ksh) |

Bank (Ksh) |

| 1/7 | Bal b/d | 20,000 | 1/7 | Bal b/d | 8,600 | ||||

| 3/7 | Jane | 1,000 | 15,000 | 3/7 | Rent | 800 | |||

| 10/7 | Cash (c) | 6,000 | 10/7 | Bank (c) | 6,000 | ||||

| 18/7 | Capital | 28,000 | 18/7 | Musa | 200 | 19,800 | |||

| 21/7 | Sales | 12,000 | 21/7 | Furniture | 5,200 | ||||

| 24/7 | Otieno | 2,000 | 8,000 | 24/7 | |||||

| 28/7 | Sialo | 3,600 | 28/7 | ||||||

| 30/7 | Cash (c) | 7,400 | 30/7 | Bank (c) | 7,400 | ||||

| 1/7 | Bal c/d | 1,600 | |||||||

| 3/7 | Bal c/d | 50,600 | |||||||

| 3,000 | 35,600 | 64,400 | 200 | 35,600 | 64,400 |

Download Business Studies Paper 2 Questions and Answers - Mang'u Mock 2020 Exam.

Tap Here to Download for 50/-

Get on WhatsApp for 50/-

Why download?

- ✔ To read offline at any time.

- ✔ To Print at your convenience

- ✔ Share Easily with Friends / Students