INSTRUCTIONS TO THE CANDIDATES

- This paper contains six (6) questions

- Answer any FIVE questions

- Each question has two sections A & B

- Each question carry 20 marks

- Answer all questions in the space provided after question six

- Answer all questions in English

-

- Outline five advantages that a partnership has over a sole proprietorship. (10mks)

- Explain how five external environment factors negatively affect a business.(10mks)

-

- Highlight five disadvantages of direct tax. (10mks)

- Kenya does not manufacture mobile phones. Describe five channels of distribution that are used to ensure those products reach the Kenyan consumers. (10mks)

-

- Discuss any Five current trends in communication (10mks)

- The following balances were extracted from the books of accounts of Fatuma as at 31st December 2020.

Additional informationSales 100,000 Sales returns 5,000 Purchase returns 2,000 Purchases 190,000 Carriage outwards 2,400 Stock (1/1/2019) 22,000 Rent 8,000 Insurance 6,000 Salaries 3,600 Discount received 2,800

As at 31st December 2009, stock was valued at shs. 42,000

Required

Prepare trading, profit and loss a/c for the year ended 31st December 2020 (10mks)

-

- Explain any Five international trade restriction methods (10mks)

- With the help of a well labeled diagram, state the effect of the shift of the supply curve to the left when demand is held constant. (10mks)

-

- Highlight Five factors that influence the level of national income in an economy. (10mks)

- As at 1st June 2019, the books of Ang’eeh showed the following balances:

Cash Kshs. 20,000 and bank overdraft amounting to Kshs. 8, 600

June 3: Nafula, a debtor, settled her account of Kshs. 16,000 by a cheque of kshs.15,000.

6: Paid rent by cash ksh. 8,000

10: Deposited kshs. 6,000 into the business bank accountfrom the cash till.

15: Settled Wanjala’s Account of shs. 20,000 and was allowed a discount of 1%

18: Deposited kshs. 28,000 in the bank from private resources

21: Cash sales kshs. 10,000

24: Ojugu, a debtor settled his account of 8,000 by cheque having deducted a 20% discount.

26: Purchased furniture of kshs.5,000 paying by cheque

28: Received kshs. 36,000 cash from Nabwire

29: The cheque deposited by Nafula on 3rd was dishonored

30: Banked all the available cash except kshs.1,600

Required: Prepare a duly balanced three column cash book for Ang’ech for the month of June 2019. (10mks)

-

- Explain the meaning and the circumstances under which each of the following means of payment may be used ;

- Cash

- Credit transfer

- Bank draft

- Standing order

- Postage stamps

- Give five differences between small scale firms and large scale firms (10mks)

- Explain the meaning and the circumstances under which each of the following means of payment may be used ;

MARKING SCHEME

-

- Advantages that a partnership has over a sole proprietorship include:

- The partnership can raise more capital through contribution unlike the sole trader’s savings.

- Consultations in a partnership enhance better decision making / management, unlike the sole trader who lacks someone to consult.

- Responsibilities in a partnership are shared hence minimizing monotony / fatique, unlike a sole trader conducts all activities in the business.

- Partners can share losses / liabilities which reduces the burden, unlike a sole trader who bares them all.

- Partners can practice specialization which improves productivity, unlike the sole traders whose quality of service / goods may be compromised.

- A permanent partnership has a perpetual life, unlike a sole proprietorship which can easily dissolve upon death / insanity / bankruptcy of the sole trader.

- Negative effects of external environment factors

- Demographic. Decline in population leads to a fall in demand for products / shortage of labour supply.

- Economic factors - Increase in taxation / fall in prices/ high interest rates leads to a decline in profitability /eats into profits.

- Socio – cultural factors - Unfavourable culture / religion / educational levels reduces demand / market for products ( E.g Muslims and Pork. Catholics and condoms)

- Technological environment – Inappropriate / poor technology leads to substandard / low quality goods / inefficiency in production.

- Political factor – Political instability / insecurity leads to theft/ destruction of business properties / stoppage of business operations

- Legal environment – Unfavourable laws / regulations/ complicated procedures lead to delay in starting of business / closure of businesses that are unable to cope.

- Customers - poor customers relations leads to decline in sales / demand for business products.

- Competition – Unhealthy completition reduces the market size of the business

- Suppliers – Lack of steady supply of raw materials leads to shortages / stoppage of work.

- Advantages that a partnership has over a sole proprietorship include:

-

- Disadvantages of direct tax include:

- Possible tax evasion: where the contributor give false or conceals some information concerning his / her income in order to reduce the amount payable.

- Non – consultation of the tax payer on the amount to be paid which may over burden the tax payer or motivate evasion.

- The tax payer does not participate in government expenditure: hence leading to lack of accountability / poor governance / corruption.

- High taxes encourage capital flight: due to decline in profit of investors

- It is paid in advance and in lump sum: hence the contributor feels the pinch

- Deterrent / hinder saying: because disponsable income is reduced

- Deterrent to work: because extra income earned attract more tax

- Deterrent to investment: especially corporate tax on profits discourage firms from investing in risky and profitable areas for fear of taxation.

- Not imposed on all citizens : Coz people who do not fall within the tax bracket are exempted hence reducing govt. revenue and leaving those within the tax bracket with no choice.

- It reduces the purchasing power leading to low living standards

- It is complicated to understand because of many formulations to be followed

- It may cause labour unrest / strikes in agitation for increased salaries.

- Channels for distributing imported mobile phones in to Kenya include

- Foreign manufacturers – local customers

- Foreign manufacturer – Foreign manufacturer’s own retail outlet – local consumer

- Foreign manufacturer – local retailer - local consumer

- FM – local wholesaler – local retailer – local consumer

- Foreigner manufacturer – local wholesaler - local consumer

- Foreign manufacturer – foreign agent – local retailer – local consumer

- Foreign manufacturer – local agent – local retailer – local consumer

- Foreign manufacturer – local agent – local wholesaler – local retailer - local consumer No splitting ( 2mks or zero)

- Disadvantages of direct tax include:

-

- Current trends in communication include

- Use of mobile phones – for passing information from anywhere anytime.

- Use of the internet for research / product promotion

- Use of e – mail for sending and receiving letter/correspondence through computer / mobile phones.

- Video conferencing – where there are more people can hold a virtual meeting / discussion while each of them is in a different location.

- Live streaming as opposed to recording an event and then posting on the internet this is a real – time conference / training where many participants can attend without leaving their home. E.g zoom, Microsoft teams.

- Increased use of social media such as facebooks, whatsap for individuals interaction / group discussions / entertainment. (naming 1mk otherwise 2mks)

- FATUMA ‘S

TRADING, PROFIT AND LOSS ACCOUNT √

FOR THE YEAR ENDED 31/12/2020

Dr Cr sh. sh. sh. sh. Opening stock

+Purchases

Purchases returns

COGAS

Closing stock

COGAS

22,000√

190,000√

2,000√

214,000√

42,000√

172,000√

172,000Sales

Sales returns

Net purchase / Turnover

Gross loss c/f100,000√

5,000√

95,000√

77,000√

172,000Gross loss / c/d

Carriage outwards

Rent

Insurance

Salaries

Total expenses2,400√

8,000√

6,000√

3,600√77,000√

20,000√

97,000Discount received

Net loss2,800√

94,200√

97,000√

- Current trends in communication include

-

- International trade restriction methods include;

- Tarrifs; The government levy heavy taxes to discourage imports / exports

- Subsidies; by meeting part of the production cost, local products become cheaper and attractive than imports

- Quotas; where a specific quantity / value of imports is allowed , hence minimizing competition

- Total ban; Where a certain commodity is prohibited from being imported in the country

- Foreign exchange controls; where the government restrict exchanging of the foreign currency with the local currency so as to control international trade.

- Administrative bottlenecks ; by lengthening the import registration procedure so as to discourage trade

- Moral persuasion; The government implores business men not ot trade in a certain commodity / reduce the quantity.

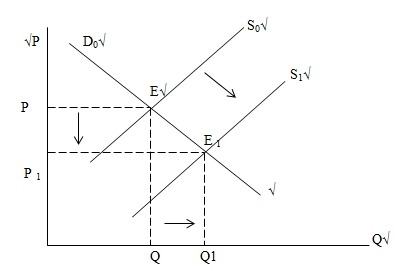

- With the help of a well labeled diagram, state the effect of the shift of the supply curve to the

left when demand constant

The equilibrium point shift from E to E1√

The equilibrium price fall from P to P1√

Equilibrium quantity increase from Q to Q1√

NB: If the student has not stated, then the three arrows in the diagram can be scored to earn one 1 mark each (therefore each tick = 1mk)

- International trade restriction methods include;

-

- Factors influencing level of national income include:

- Natural resources - A country endowed with resources can produce more goods and services to increase income and vice versa.

- Labour / human resource – A country with large skilled labour force can utilize it to increase the income and vice versa.

- Capital – a country with adequate capital can invest to generate more income and vice versa

- Level of technology – a country that uses modern technology in production increases output and vice versa.

- Political stability / good governance - create confidence in investors for increased production while poor governance / corruption leads to damage / reduced investment / less production

- Entrepreneurial culture - a culture that encourages hard work leads to production of goods and services hence increased income and vice versa .

- Foreign investment service hence increased income and vice versa.

- Dr ANG’ECH THREE COLUMN CASH BOOK FOR THE MONTH OF JUNE 2019 Cr

Date Details F Disc. All.(sh) Cash sh. Bank Sh Date Details F Disc. All.(sh) Cash Bank Sh 1/6/19 Balance b/d 20,000 1/6/19 Balance b/d 8,600 3/6/19 Nafula 1,000 6/6/19 Rent 8,000 10/6/19 Cash 6,000 10/6/19 Bank C 6,000 18/6/19 Capital 15/6/19 Wanjala 200 19,800 21/6/19 Sales 10,000 20/6/19 Furniture 5,000 24/6/19 Ojugu 1,600 29/6/19 Nafula 15,000 28/6/19 Nabwire 36,000 30/6/19 Bank C 36,600 30/6/19 Cash C 36,000 30/6/19 Balance c/f 1,600 57,400 2,600 72,000 86,000 200 72,000 86,000 Balance b/d 1,600 57,400

- Factors influencing level of national income include:

-

- Meaning and circumstances for the use of the means of payment :

- Cash – payments using notes and coins. Used when the amount of money involved is small / the seller does not have a bank account or mpesa line.

- Credit transfer – payment of various people at ago by using one cheque. Used when paying salaries of employees in a particular organization.

- Bak – draft – cheque drawn by a bank on itself upon receiving money from a customer who wants to use the facility. Used where the payee wants quaranteed payment / doesn’t accept personal cheque

- Standing order – order by account holder to his / her bank to be making regular payment / insurance premium / hire purchase investments.

- Postage stamps – payment by use of postage stamp which the payee can sell or use for posting letter / paying somebody else. Used when payment required is a small amount of money.

(Definition 1 mk circumstance 1 = 10mks)

- Differences between small scale retailers and large scale retailers include:

Small scale retailers Large scale retailers Require little capital to start Require a large capital outlay Few legal formalities to register Long legal registration procedure Easy decision making Lengthy decision making process due to consultations Are flexible in terms of place / objectives Are rigid to change place / objectives Require few workers / labourers / work force Require many workers Occupies a small flow space Occupies a large floor space Command / serves a small market Command / serves a larger market Easy / simple to manage Require a complex management system / skills May not enjoy economics of scale Enjoy economics of scale

- Meaning and circumstances for the use of the means of payment :

Download Business Studies Paper 2 Questions and Answers - Samia Joint Mock Examination 2021/2022.

Tap Here to Download for 50/-

Get on WhatsApp for 50/-

Why download?

- ✔ To read offline at any time.

- ✔ To Print at your convenience

- ✔ Share Easily with Friends / Students