INSTRUCTIONS TO CANDIDATES.

- This paper consist of six questions.

- Answer only five questions in the writing material provided.

- Indicate clearly the questions answered.

-

- Explain five factors that encourage entrepreneurial development in Kenya. (10mks)

- Highlight five characteristics of an efficient tax system. (10mks)

-

- Dr Walden would like to pass a message to a firend. Explain five factors he is to consider in choosing the most appropriate means of communication to use. (10mks)

- Describe any five source of document that a business may have access to. (10mks)

-

- Explain five benefits of direct production. (10mks)

- The following information relates to Maralal Traders for the month of May 2014.

May 1: Balance brought forward

Cash shs 180,000

Bank shs 450,000 (Cr)

3: received a cheque of 1,500,000 from Mpasha, a debtor

7: Cash sales shs 280,000

11: Jolloimat, a creditor of shs 600,000 was paid by cheque of sh 400,000 and the balance by cash

14: Received commission in cash shs 150,000

17: A debtor, Leteipa, paid his account of 185,000 by cheque less 2% cash discount.

19: Paid the following expenses by cheque:

Rent shs 75,000

Electricity shs 32,000

Water shs 25,000

21: Withdrew shs 100,000 from bank for personal use.

24: Paid cash shs 133,280 to Kinai after deducting a cash discount of 2%

25: Received a cheque of sh 200,000 from Kiyapi, a debtor

28: Paid salaries shs 120,000 by cheque

31: Banked all cash except shs 50,000

Required:

Record the above transactions in a three column cash book. (10mks)

-

- Explain five differences between private limited companies and partnerships forms of business units. (10mks)

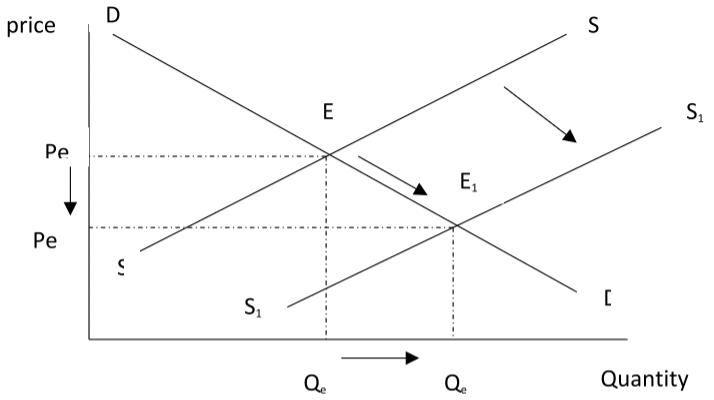

- Explain clearly with aid of a diagram the change of equilibrium as a result of increase in supply of a commodity. (10mks)

-

- Explain five challenges that an underpopulated country may experience. (10mks)

- Explain five measures that a wholesaler would take to ensure smooth running of his warehouse. (10mks)

-

- Highlight four circumstances under which a cheque may be dishonoured. (8mks)

- The following trial balance related to Kimani;s business as at 31st December 2012

DR(SHS) CR(SHS)

Stock on 1st January 2003 60,000

Purchases and sales 400,000 580,000

Returns 20,000 50,000

Debtors and creditors 65,000 40,000

Premises 540,000

Machinery 200,000

Fixtures and fittings 100,000

Carriage outwards 8,000

Wages and salaries 30,000

Discounts 25,000 32,000

Commissions 16,000 14,000

Cash in hand 70,000

Capital 818,000

1,534,000 1,534,000

Required:

Prepare a trading profit and loss account for the period ended 31st December 2012 and a balance sheet as at that date if the closing stock was worth shs 70,000 (12mks)

MARKING SCHEME

-

-

- Improved infrastructure; good roads, adequate security, availability of water, electricity will encourage entrepreneurial development.

- Favorable government policies such as lessening tax burden by providing tax holidays, providing incentives and simplifying procedures and cost of obtaining relevant legal documents required.

- Availability of market for goods and services/ Expanded market due to devolution of service

- Increased accessibility to education and training/ Expanded capacity to provide training for better skills to entrepreneurs.

- Availability of resources/Increased accessibility to credit from commercial financial institutions and also from the government through government initiated projects like uwezo fund and women enterprise funds.

- Political stability/absence of political chaos/No inter-clan fighting creates a conducive environment for entrepreneurs to venture into investments with confidence.

- Favorable natural conditions/enough rainfall for agro-based business.

(Any 5 well explained x 2 = 10mks)

-

- Equity – the tax should be fair/just /people should be taxed according to their level of income.

- Economical – ft should be cheap/easy to administer/cost effective/cost of collection should be relatively lower than tax revenue.

- Convenient / method of payment / collection should be convenient to the tax payer – it should be suited/ favorable to the needs / activities / programmes of the tax payer.

- Certainity – tax payer/collectors should know what/when/how to pay /collect.

- Flexibility – (where a tax is used as an instrument of national policy) it should be adaptable to all (economic) circumstances/conditions/subject to revision.

- Simplicity – it should be easily understood/administered

- Elasticity – proceeds front taxation should be capable of expand / contracting with changes in income/population

- Diversity/wide base there should be a (wide) variety/range if taxes/net many tax payers.

- Difficult to evade – it should not create a loophole for people to escape / dodge.

- Should regulate the economy – by encouraging production/proper allocation of resources

- Should have (maximum) benefits to taxpayers through provision of quality goods/services/to encourage them to pay.

(any five with explanation = 10mks)

-

-

-

- Accuracy – the means should convey the message in exactness.

- Availability of the medium

- Characteristics of communicating parties – both sender and receiver should have the required skills to retrieve and interpret msg correctly.

- Complexity of msg – the medium should have capacity to handle the bulk of the msg without loss of details.

- Confidentiality – to the intended person only.

- Cost – should be affordable.

- Derived impression to the recipient.

- Distance – geographical gap between sender and receiver.

- Need for evidence – proof that message was conveyed.

- Reliability – certainty that msg gets to intended person.

- Speed – how fast msg gets to recipient and feedback given

-

- Cash receipt / cash sale slip – evidence that cash has been paid out or received.

- Cheques and counterfoils – evidence of payment.

- Invoice – demand for payment on goods already delivered to buyer on credit

- Returned goods note – goods returned to the seller either to supplier or to the business

- Debit note – correct undercharge

- Credit note – correct overcharge

- Payment voucher – where receipts aren’t available for payment using petty cash

-

-

-

- Cost is affordable as the capital required for one to produce goods for one’s own consumption is less compared to indirect production.

- No wastage as one produces what he/she can produce what he or she can consume alone hence no extras which can get spoilt.

- Variety of goods and services as one can produce different type of goods at the same time.

- Involves use of locally available simple tools hence one may not necessarily need advanced technology which could be expensive to acquire.

- Independence; as production is self-sufficient and producers produce enough for their own use.

Three-column mcash book

Date Details L.F. DRC Cash bank Date Details L.F D.AI Cash Bank 2014

May 1Balance b/f 180,000 2014

May 1Balance b/f 20,000 450,000 May 3 Mpasha 1,500,000 May 11 Jolloimat 40,000 May 7 Sales 280,000 May 19 Rent 75,000 May 14 Commission 150,000 May 19 Electricity 32,000 May 17 Leteipa 3,700 181,300 May 19 Water 25,000 May 21 Drawings 100,000 May 24 Kinai 2,720 133,280 May 25 Kiyiapi 200,000 May 28 Salaries 226,720 120,000 May 31 Cash c 226,720 May 31 Bank c 50,000 May 31 balance c/f 610,000 906,020 610,000 2,180,020 2,108,020 June 1 Balance b/f 50,000 906,020

-

-

-

Private company Partnership 1. Have a minimum of 2 shareholders to 50 members 1. The business is owned by two or more persons with a maximum of twenty for ordinary partnership 2. The business can be managed by one director or two if big 2. The business is managed by active partners jointly 3. Do not allow the transfer of shares 3. They do not deal with shares but members contribution 4. All members have limited liabilities 4. One partner has unlimited liability except other who have limited liabilities. 5. Separate legal entity 5. No separate legal entity -

-

-

-

- Limited labour supply – A small population may not provide enough labour

- Limited market – A small population may not provide enough market for goods and services. Some business may end up closing down.

- Underutilization of resources – resources in the country may be left idle because of lack of people to use them.

- Uneconomical to provide public utilities the available population may be scattered all over the country making it uneconomical for the government to provide public utilities.

- Lack of specialization – people in an under populated country may not engage in specialization leading to production of poor quality goods.

- Reduced phase of economic development for under populated countries, there is less resources. This reduces peoples creativity and innovation that may

-

- It should be spacious enough to accommodate as many goods as possible.

- It should appropriate equipment and facilities that twill facilitate quick receipt and movement of the goods.

- It should have adequate safety facilities to ensure adequate protection of goods against damage of goods.

- It should be located near good transport network to facilitate faster movement of goods in or out of the warehouse.

- It should have appropriate staff (skilled) to manage the receipt and recording activities of the warehouse.

- It should have the necessary special facilities for the storage of goods.

- It should have proper recording of activities that take place to ensure adequate monitoring of stock movements.

- It should conform to the existing government requirements for warehousing.

-

-

-

- If it is postdated.

- If it is stale

- If there insufficient fund in the drawer’s account

- If the cheque has omissions eg not singed, no date

- If amount in words varies with the amount in figures

- If the signature of the drawer differs with the bank specimen signature.

- If bank learns about death, insanity or bankruptcy of the drawer.

- If there is alteration not signed against.

- Kimani’s

Trading and profit and loss account

For the period ended 31st Dec 2012

Dr Cr Shs

Opening stock 60,000Add: Purchases 400,000

Less: Return outwards 50,000 350,000

Cost of goods available

for sale 410,000

Less: Closing stock 70,000

Cost of goods sold 340,000

Gross Profit c/d 220,000

560,000

Carriage outwards 8,000

Wages and salaries 30,000

Discounts allowed 25,000

Commissions allowed 16,000

Net Profit c/d 187,000

266,000Shs

sales 580,000

Less: Returns inwards 20,000

Gross profit b/d 560,000

200,000

Discounts received 32,000

Commissions received 14,000

266,000

Net profit b/d 187,000

-

Download Business Studies Paper 2 Questions and Answers - Chogoria Murugi Zone Pre Mock Exams 2023.

Tap Here to Download for 50/-

Get on WhatsApp for 50/-

Why download?

- ✔ To read offline at any time.

- ✔ To Print at your convenience

- ✔ Share Easily with Friends / Students