Instructions to Candidate

- Write your name and index number on the spaces provided.

- Sign and write the date of examination on the spaces provided.

- Answer ANY FIVE questions. All the answers should be written on the spaces provided.

- This paper contains 3 printed Pages.

- The candidate should check the question paper to ascertain that all pages are printed as indicated and that no question is missing.

- Candidates should answer the questions in English:

QUESTIONS

-

- Ordinary shares and debentures are both sources of capital to limited liability companies. Explain FIVE differences between the two. (10 marks)

- Explain FIVE factors that may lead to demand pull inflation. (10 marks)

-

- The following Table shows the percentage contribution in each of the three levels of production in generating INCOME to a country.

| FACTORS OF PRODUCTION |

PRIMARY |

SECONDARY |

TERTIARY |

| % INCOME CONTRIBUTION |

55 |

30 |

15 |

Explain FOUR factors that may have led to a higher proportion of income contributed at the primary level. (8 marks)

- The following trial balance was extracted from the Ledgers of Ashioya's electronics business on 30th April 2010.

Ashioya's Electronics

Trial Balance

As at 30th April 2010 |

| TITLE OF ACCOUNT |

DEBIT (Dr) SHS. |

CREDIT(Cr) SHS. |

| Equipment |

90,000 |

|

| Motor vehicle |

250,000 |

|

| Sales |

|

320,000 |

| Returns Inwards |

12,000 |

|

| Purchases |

160,000 |

|

| Returns outwards |

|

34,500 |

| Stock (1/5/2009) |

86,400 |

|

| Electricity |

12,900 |

|

| Rent |

18,300 |

|

| Discount received |

|

19,300 |

| Salaries |

36,000 |

|

| Insurance |

14,500 |

|

| Cash at bank |

34,500 |

|

| Debtors |

63,000 |

|

| Capital |

|

374,400 |

| Creditors |

|

29,400 |

| TOTAL |

777,600 |

777,600 |

Stock on 30th April 2010 was valued at shs. 77,000.

Prepare:

- A trading profit and Loss account for the year ended 30th April 2010 (8marks)

- A balance sheet as a 30th April 2010. (4marks)

-

- Explain five factors that can lead to unfavourable balance of payment. (10marks)

-

MAMBO TRADERS

BALANCE SHEET

As at 1" June 2009 |

| |

Sh |

|

Sh |

| Equipment |

160,000 |

Capital |

272,000 |

| Stock of goods |

90,000 |

creditors |

40,000 |

| Bank |

52.000 |

|

|

| Cash |

10.000 |

|

|

| |

312.000 |

|

312.000 |

During the first week of June the following transactions took place in the business: 2009

- June 2: Mambo introduced additional funds into the business sh. 38,000

- June 3: Purchased a motor vehicle from Mashalls Ltd worth sh. 200,000 on credit

- June 5: Paid a creditor sh. 6000 cash

- June 6: Sold goods on credit to Anita sh. 25,000

- June 7: Bought equipments worth sh. 50,000 by cheque

Prepare the balance sheet of Mambo traders as at 7 June 2009 to record the above transactions (10marks)

-

- Explain FIVE ways in which the central bank acts as a banker to the government (10 Marks)

- The following were the balances of Maramoja traders as at 1 Jan 2010. Cash sh. 40,000, bank overdraft sh. 17,000. During the following months, the following transactions took place:

- Jan 2nd Musau a debtor settled his account of sh. 32,000 by cheque of sh. 30,000

- 4th paid salaries and wages amounting to sh. 16,000

- 10th Deposited sh. 12,000 into the business bank account from the cash till.

- 14th Settled Wayua's account of sh. 40,000 and she was allowed a discount of 1% through a cheque.

- 16th Deposited sh. 56,000 in the bank from private sources.

- 17th sold goods for cash sh. 24,000

- 20th Mutua, a debtor, settled his account by a cheque of sh. 16,000 having been allowed a discount of 2%

- 24th Purchased furniture sh. 10,400 paying by cheque

- 26th received sh. 7,200 cash from Odhiambo

- 30th Banked all the available cash except only sh.3,200

Required: Prepare a 3 column cashbook for Maramoja traders. (10 marks)

-

- As a County Governor, explain FIVE ways in which the National Income statistics will be of benefit to you (10 marks)

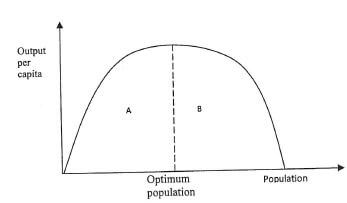

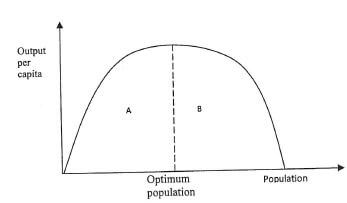

- The diagram below represents the population and output per capita of a certain country. Explain any five challenges to the country if her total population is found at the part marked B. (10marks)

-

- Explain FIVE methods of price determination of products other than price mechanism in a market. (10 marks)

- Explain FIVE reasons why the Kenya government must collect taxes from its citizens. (10 marks)