- Explain five principles of insurance.

-

Principles of indemnity

This principle state that insured can only be compensated for the actual loss suffered. The aim of the insurance company is to compensate the loss suffers for what they have actually lost financially being returned to the same financial position but no to benefit them. -

Principle of utmost good faith or “ubernima fides”

At the time of signing the insurance contract the proposer is expected to give all the relevant material faults relating to the [property he wants to insure. -

Principle of insurance interest

It states that, the insured should only insure property or life whose loss will affect him financially hence one cannot insure a friend’s property. -

Principle of proximate cause

For the insured to be compensated, there must be very close relationship between the loss suffered and the rick insured. -

Principle of subrogation

After the insured has been compensate, the remnant of the insured item becomes the property of the insurer. This ensures that the insured person does not make against (profit) out of insurance. -

Principle of contribution

This principle state that where a person has insured the same property with more than one insurance company. Upon the occurrence of the event of loss, all the insurance company will share the loss proportionately.

-

- Study the following table of the demand and supply of product x.

Period 2010 Price/Units Qtn dd/units July Shs 300 500 August Shs 300 400 September Shs 300 200 October Shs 300 80 November Shs 300 50

Explain five factors that may have led to the trend above.-

Government policy

The government may have come up with policies that have discouraged the consumption of project x by levying heavy taxation on the product, lack of subsidies and laws and regulation that have discouraged consumption which have led to this trend. -

Uneven distribution of income

Demand for goods and service is usually higher when incomes are distributed among many people as opposed to where incomes are in the hands of few people. A change in this trend explains that there is uneven distribution of incomes which has led to a decrease in the quantity demanded. -

Decrease in population

There is a decrease in population which has led to a decrease in demand for goods x while the composition of the population in terms of its sex. Age, economic stats and education structure will also affect the demand for the product. -

Terms of sale

The demand for goods and services can increase if and when favourable terms of sale are offered to consumers. The terms of sale my include offering goods on credit, giving discounts etc. So for this case may be these was a decrease in the availability of credit or introduction of tougher credit terms which has led to a reduction in demands for the goods and services. -

Negative change in tastes fashion and preferences of consumers

Individual’s tastes have a great influence on the demand for a commodity. If the consumer develops a negative taste for a particular product, then this will clearly be reflected with a decrease in the quantity demanded. So in this case, the consumers might have a negative taste and a preference of product x.

-

- Explain five principles of insurance.

- Giving the types of unemployment, state the causes of the remedies.

-

Structural unemployment

This type of unemployment occurs when the supply of a particular category of workers exceeds the demand for the services e.g. supply for white collar jobs exceeds the job availability. So the possible cause for this unemployment occurs when the persons have different skills from those being demanded by the employers so the solution is to train the employees and also the government is to introduce the appropriate forms of education in schools and institutions to equip the school-leavers with relevant skills and attitudes for the existing job opportunities. -

Frictional unemployment

This is a short-term unemployment that occurs as people adjust to market changes for instance, by quitting an existing job to seek a new one. This may be caused by people becoming too selective when choosing the jobs they want which may not be available in the market. The possible solutions for this would be to export labourers where there are too many skilled people and the government to provide travel permits for people to take up jobs outside the country.

-

Voluntary / real wage unemployment

It occurs where people choose not to work because they consider the remuneration to be low. The possible cause for this is where there is low demand for goods and services due to low incomes which result to a decline in economic activities and consequently a decline in employment. The solution for this is to encourage firms to use appropriate methods of production such as labour intensive techniques to enable more people to be absorbed in the available jobs. -

Cyclical unemployment

This is unemployment which arises due to situations in the economic activities over a period of time in a pattern known as trade cycle. The possible cause is where low demand for goods and services due to low incomes which result to a decline in economic activities. The solution is where the government needs to initiate major projects that increase the government expenditure. -

Residual unemployment

This unemployment arises due to handicaps such as mental disorders and blindness which hinder people from engaging in production activities. The possible solution for this is to encourage government to introduce foreign investors in many ways to cater for this people.

-

- You are a sales executive with a local bank. Describe five steps that you must follow when sent to the field to promote the products of the bank. (10 marks)

-

Identifying the prospective customers

-

Preparing the presentation

-

Establishing customer contacts

-

Arousing interest in the products

-

Dealing with objections

-

Closing the sale

-

After-sale services

-

- Giving the types of unemployment, state the causes of the remedies.

- Discuss five reasons why a country’s economy is showing slow increase in their National Income (10 marks)

-

Poor supply and low productivity of the labour force

-

Inadequate capital necessary for the exploitation of natural resources

-

Poor natural resource endowment

-

The technology used may be poor and inappropriate

-

Effects of political instability

-

Citizens’s laziness and negative attitude towards work

-

Presence of a large subsistence sector

-

Low levels of foreign investment

-

- Explain five problems that are likely to face the process of implementation of well-prepared economic development plans (10 marks)

-

Reliance on donor funding

-

Limited supply of domestic resources such as skilled personnel, finance and capital

-

Earlier failure to involve the local people in plan formulation

-

Natural calamities

-

Trying to implement unrealistic, over-ambitious plans

-

Lack of corporation among executing officers

-

Inflation

-

Lack of political will

-

- Discuss five reasons why a country’s economy is showing slow increase in their National Income (10 marks)

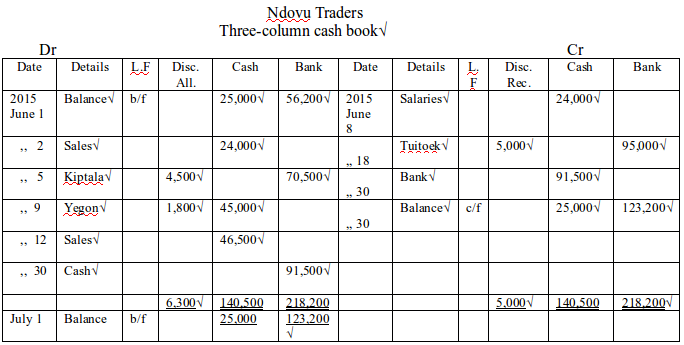

- On 1st June 2015, Ndovu Traders had cash in hand of sh.25,000 and sh.56,200 at bank.

During the month, the following transactions took place:

2015

June 2 Cash sales, sh.42,000.

June 5 Received a cheque of sh.70,500 from Kiptala Traders after deducting a6% cash discount.

June 8 Paid salaries, sh24,000cash.

June 9 Yegon settled his account of sh.45,000 in cash and was allowed sh.l,800 cash discount.

June 12 Cash sales sh46,500.

June 18 Paid Tuitoek's debt of sh.l00,000 by cheque after deducting 5% cash discount.

June 24 Withdrew sh.26,000 from the bank for office use.

June 30 Banked all the cash except sh.25,000.

Prepare a 3-column cashbook and balance it off on 30th June, 2015. (10 marks)

- Explain five factors that may hinder effective communication in an organization. (10 marks)

-

Noise barriers: It refers to a loud, surprising, irritating or unwanted sound that disrupts the effective communication process. It may be from telephone interruptions that cause disturbance in the process of communication.

-

Choice of inappropriate channel: In accordance with the importance and the intensity of the message, a proper channel must be selected. If a poor channel is selected, it is likely that the message gets distorted or does not have the desirable effect.

-

Information overload: Care must be taken when providing the amount of information to others lest they may lose it due to the information being overloaded. It is worth mentioning that while managing the people, a manager must make out how capable is a particular employee in processing the message and how much information can be provided to him or her.

-

Poor Timing: Although urgent needs of a business do not specify any timing, there may be some rare cases. However, the timing of providing a particular message to others should be appropriate. If the information is communicated at the eleventh hour, it may result in resentment and causing the employees to lose the interest in performing particular activity.

-

Physical distractions: physical distractions may cause disturbances to the effective communication process. Such as, telephone interruptions or visitors walk in on the manager and subordinates in the middle of a discussion.

-

Improper and inadequate information: one of the facts that spells the difference between effective and ineffective communication is the quality of a message. A good message contains meaningful and appropriate information while it incorporates language rules with proper choice of words. A poor message whether spoken or written does not produce intended effect, while it creates ambiguity and leads to misinterpretations.

-

Poor body language attracts negative responses from others, whereas displaying poor body language not only makes bad impression on others, but also takes somebody’s attention away from the effective communication process.

-

Listening skills; good listening skills lead to full apprehension of a message, while poor listening distorts the message.

-

- On 1st June 2015, Ndovu Traders had cash in hand of sh.25,000 and sh.56,200 at bank.

- Explain five factors that influence the choice of a product to produce. (10 marks)

-

Market/Supply-gap: The size of the unsatisfied market demand which constitute a source of business opportunity will dictate, to a great extent the need to select a particular product. The product with the highest chances of success as reflected in its demand will be selected. In essence, there must be existing obvious demand for the selected product.

-

Finance/Fund: The size of the funds that can be mobilized is another important factor. Adequate fund is needed to develop, produce, promote, sell and distribute the product selected.

-

Availability of and Access to Raw Materials: Different products require different raw materials. The source quality and quantity of the raw materials needed are factors to be seriously considered, Are the raw materials available in sufficient quantities? Where are the sources of raw materials located? Are they accessible? Could they be sources locally or imported? Satisfactory answers should be provided to these and many other relevant questions.

-

Technical Implications: The production process for the product needs to be considered. There is need to know the technical implications of the selected product on the existing production line, available technology and even the labour force. The choice of a particular product may require either acquisition of the machineries or refurbishing of the old ones. The product itself must be technically satisfactory and acceptable to the user.

-

Profitability/Marketability: Most often, the product that has the highest profit potential is often selected. However, a product may be selected on the basis of its ability to utilize idle capacity or complement the sale of the existing products. The product must be marketable.

-

Availability of Qualified Personnel: Qualified personnel to handle the production and marketing of the product must he available. The cost of producing the product must be kept to the minimum by reducing wastages. This is achievable through competent hands.

-

Government Policies: This is quite often an uncontrollable factor. The focuses of government policies can significantly influence the selection of product. For instance, a package of incentives from government for a product will boost its production.

-

Government objectives: The contributions of the product to the realization of the company’s short and long range objectives must be considered before selection. For instance, the company goal maybe the achievement of sale growth, sales stability or enhancement of the company’s social value.

-

- Discuss five errors that may not be noticed in a trial balance. (10 marks)

- Error of omission

This is an error where a transaction is completely omitted from the books. No entries were made at all for the transaction. It is as if the transaction has not existed. - Error of commission

In this case, double entry was observed but the transaction was posted to a wrong account of the same class. For example goods sold to John was correctly credited to Revenue (Sales) account but debited to Jane’s account.

-

Error of principle

Double entry observed but an entry made in the wrong class of account. For example, payment by cheque for vehicle repairs correctly credited to bank account but debited to vehicle account instead. In this case, not only the account is wrong (vehicle instead of vehicle repairs) but also the class of account is different. Vehicle account is a real account (asset) whereas vehicle repairs account is a nominal account (expense). -

Error of original entry

The transaction was correctly recorded according to the double entry system but with the wrong amount. For example, payment of telephone expenses in cash of shs560 was credited to cash account and debited to telephone expenses account but by shs600 in both accounts. -

Complete reversal of entries

For a given transaction, the account to be debited was credited and the account to be credited was debited. For example, goods sold to Nadia for shs500 was debited to Revenue (Sales) account and credited to Nadia’s account, both by shs500. -

Compensating errors

Errors on the debit side of the ledger have been set off by errors on the credit side of the ledger. For example, vehicle account (debit balance) and commission received account (credit balance) were both understated by shs200. -

Error of duplication

A transaction was recorded twice in the ledger. Double entry was observed in each case. -

Error of transposition

For a given transactions, double entry was correctly observed but the figures in amount were not written in the correct order. Examples are: writing shs450 instead of shs540, shs71 instead of shs17, shs1 425 instead of shs1 452, etc. For example, cash received from Sam shs164 was debited to cash account and credited to Sam’s account at shs146.

- Error of omission

- Explain five factors that influence the choice of a product to produce. (10 marks)

- Discuss five canons of public expenditure. (10 marks)

-

The Principle of Maximum Social Advantage: The government expenditure should be incurred in such a way that it should give benefit to the community as a whole. The aim of the public expenditure is the provision of maximum social advantage. If one section of the society or one particular group receives benefit of the public expenditure at the expense of the society as a whole, then that expenditure cannot be justified in any way, because it does not result in the greatest good to the public in general. So we can say that the public, expenditure should secure the maximum social advantage.

-

The Principle of Economy: The principle of economy requires that government should spend money in such a manner that all wasteful expenditure is avoided. Economy does not mean miserliness. By economy we mean that public expenditure should be increased without any extravagance and duplication. If the hard-earned money of the people, collected through taxes, is thoughtlessly spent, the public expenditure will not confirm to the cannon of economy.

-

The Principle of Sanction: According to the principle, all public expenditure should be incurred by getting prior approval from the competent authority. The sanction is necessary because it helps in avoiding waste, extravagance, and overlapping of public money. Moreover, prior approval of the public expenditure makes it easy for the audit department to scrutinize the different items of expenditure and see whether the money has not been overspent or misappropriated.

-

The Principle of balanced Budgets: Every government must try to keep its budgets well balanced. There should be neither ever recurring surpluses nor deficits in the budgets. Ever recurring surpluses are not desired because it shows that people are unnecessarily heavily taxed. If expenditure exceeds revenue every year, then that too is not a healthy sign because this is considered to be the sign of financial weakness of the country. The government, therefore, must try to live within its own means.

-

The Principle of Elasticity: The principle of elasticity requires that public expenditure should not in any way be rigidly fixed for all times. It should be rather fairly elastic. The public authorities should be in a position to vary the expenditure as the situation demands. During the period of depression, it should be possible for the government to increase the expenditure so that economy is lifted from low level of employment. During boom period, the state should be in a position to curtail the expenditure without causing any distress to the people.

-

Equity/No unhealthy effect on Production and Distribution: The public expenditure should be arranged in such a way that it should not have adverse effect on production or distribution of wealth in the country. Public expenditure should aim at stimulating production and reducing inequalities of wealth distribution. If due to unwise public spending, wealth gets concentrated in a few hands, then its purpose is not served. The money really goes waste then.

-

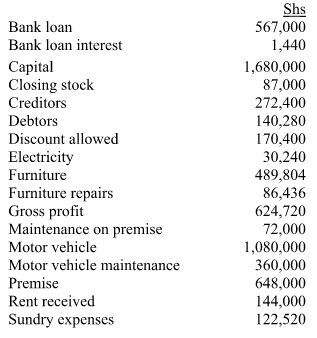

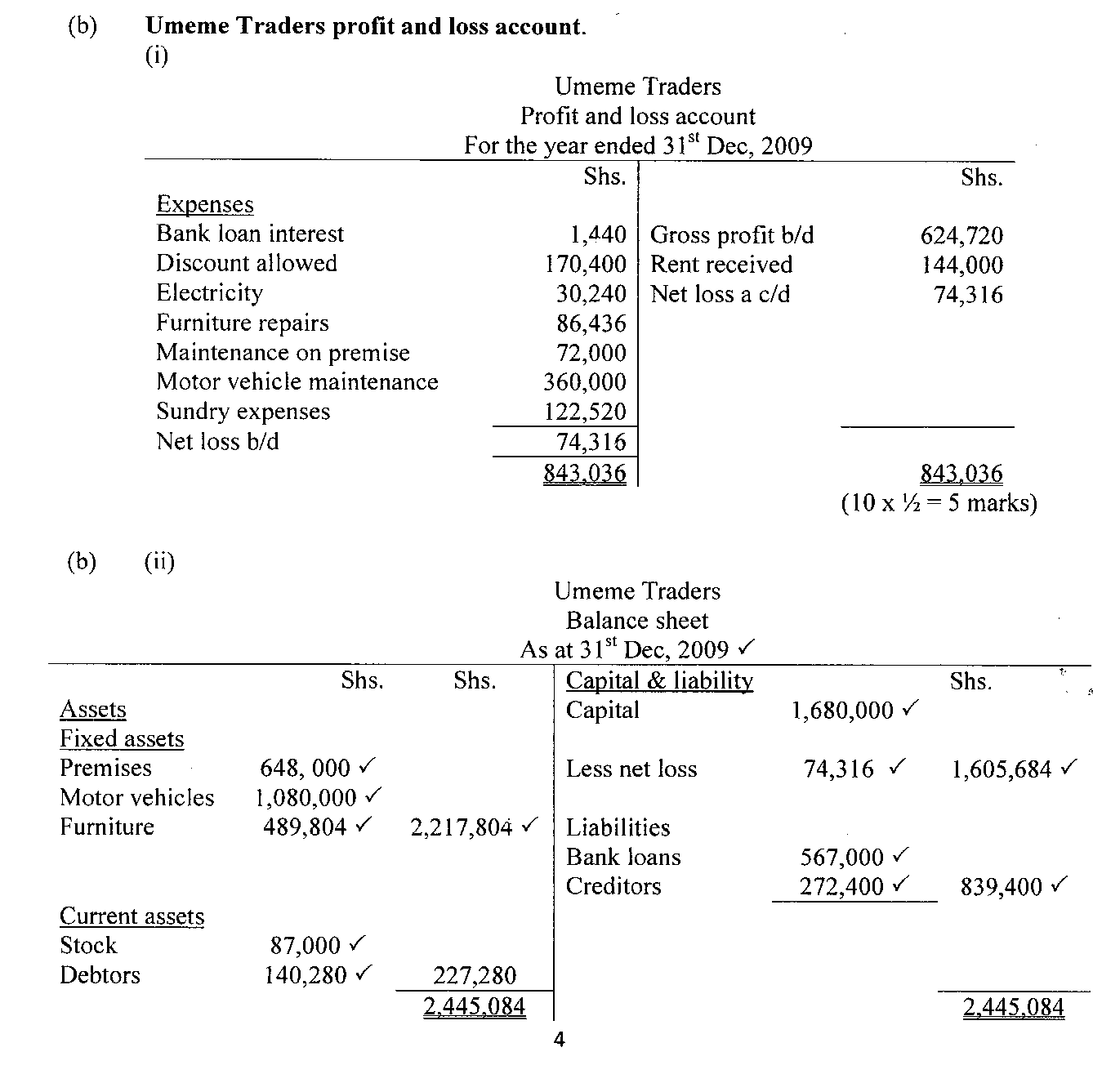

- The following information was extracted from the books of Umeme Traders as at 31st December 2009.

Prepare:- Profit and loss account for the year ended 31st December 2009.

- Balance sheet as at 31st December 2009. (10 marks)

- Discuss five canons of public expenditure. (10 marks)

Download KASSU JOINT EXAMINATION 2016 BUSINESS STUDIES Paper 2 with answers.

Tap Here to Download for 50/-

Get on WhatsApp for 50/-

Why download?

- ✔ To read offline at any time.

- ✔ To Print at your convenience

- ✔ Share Easily with Friends / Students