Instructions

- This paper consists of six questions.

- Answer any five questions.

- Write your answers in the answer sheets provided.

- All questions carry equal marks

QUESTIONS

-

- Discuss five benefits that a customer may get by using automated teller machines (ATMs)for financial transactions (10marks)

- Explain five demerits of output approach in measuring national income (10marks)

-

- Explain five government-initiated methods of consumer protection (10marks)

- Explain five types of direct taxes that the government may use to collect revenue from individuals and companies (10 marks)

-

- Explain five clauses that must be specified in Memorandum of Association of a public limited company (10 marks)

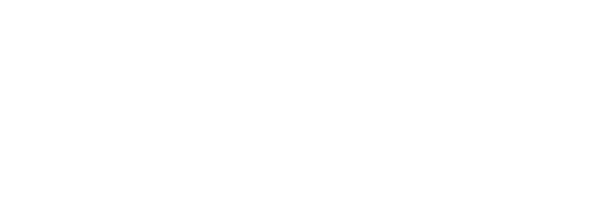

- The following information relates to Wako traders

Details sh

stock 1St January 2022 43000

purchases 95000

sales 123000

carriage outwards 2500

carriage inwards 1000

returns outwards 2000

returns inwards 3000

general expenses 10000

insurance 2500

stock 31st December 2022 47000

calculate:- Turnover (1 mark)

- Rate of stock turnover (3 marks)

- Mark up (2marks)

- Margin (2marks)

- Net profit (2marks)

-

- Discuss five causes of unfavorable balance of payment for most developing countries (10 marks)

- Explain five factors that an entrepreneur would consider when evaluating a business idea (10 marks)

-

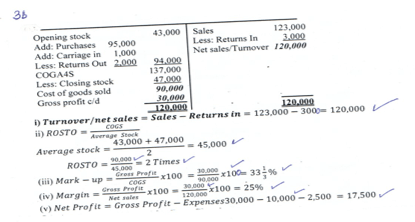

- On 1st January 2012, Chumo traders had the following balances: cash 15000 and bank 40000

During the month, the following transactions took place.

Jan: 2 Maritim, a debtor fully settled his account of sh 10000 by cheque of shs 8000

5 Deposited sh 4000 into the business bank account from the cash till

9 Paid wages by cash sh 5000

14 sold goods in cash sh 14000

17 purchased office equipment worth shs 3000 paying by cheque

18 settled Korirs account sh 10000 by cash after being allowed a discount of 5%

21 received sh 6000 cash from Kolongei a debtor

23 Tangus, a debtor settled his sh 4000 account by cheque having been allowed a discount of 20%

27 Deposited shs 17000 in the business bank account from private sources

30 Banked all the cash in the till except sh 1000

Prepare a three-column cash book duly balanced (10 marks) - Explain five ways of making face to face communication effective (10 marks)

- On 1st January 2012, Chumo traders had the following balances: cash 15000 and bank 40000

-

- Explain five negative implications of a youthful population (10marks)

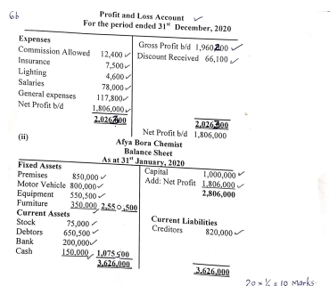

- The following trial balance was prepared by Afya Bora Chemist on 31st December 2020

Particulars

DR sh

CR sh

Premises

Debtors

Creditors

Motor vehicle

Equipment

Gross profit

Furniture

Stock

Bank

Cash in hand

General expenses

Discount received

Commission allowed

Insurance

Lighting

Salaries

Capital

850000

650500

800000

550500

350000

75000

200000

150000

117800

12400

7500

4600

78000

820000

1960200

66100

1000000

3846000

3846000

Using the information given above prepare:- A profit and Loss account (4 ½ marks)

- A balance sheet (5 ½ marks)

MARKING SCHEME

-

- Discuss five benefits that a customer may get by using automated teller machines (ATMs)for

financial transactions (10marks)- customers can withdraw and deposit money at any time

- customers can deposit money or cheques AT any time since it offers a twenty-four-hour service

- customer can pay utility bills such as electricity through the ATMs

- fees charged for withdrawal is low compared to over-the-counter withdrawals

- ATMs may be found even where banks are non-existent hence convenient and easily accessible to customers

- The customer has a pin number which guarantees confidentiality and safety for his/her money

- customer can use it to monitor his transactions with the bank by getting mini statements

- Customers can make interbank withdrawals by use of visa cards

- ATM cards are secure and very easy to carry around

- Explain five demerits of output approach in measuring national income (10marks)

- problem of valuing government output/services since they may not be paid for/sold at market prices/ are subsidized

- problem of subsistence output since goods/services are not marketed

- difficult of deciding what goods or services to include/ unpaid for household chores and yet they are produced using resources thereby leading to understating the national income

- difficult in valuing stock at the end of the accounting year/unsold stock as it differs with the value at the production time.

- Fluctuations in prices which may cause output to appreciate or depreciate in value

- Problem of double counting/ may be difficult in distinguishing between intermediate and final goods

- Inaccurate/ incomplete data leading to wrong valuation/due to poor record keeping

- Inadequate finance/capital /technology that limits computation of data

- Unskilled personnel leading to inefficiency in collection and computation of output data

- Problem of illegal products. E.g., illicit alcohol and bhang which generates income but they are not included in calculation of national income

- Discuss five benefits that a customer may get by using automated teller machines (ATMs)for

-

- Explain five government-initiated methods of consumer protection (10marks)

- Setting standards/KEBS to ensure that goods and services are of required quality and specifications

- Licensing of firms to control the number of firms so as to eliminate unhealth competition

- Price control. Government sets the price beyond which the consumers should not be charged

- Weights and measures act which ensures that commodities sold are of the correct weight and measurement

- foods and drugs act which ensures that manufacturers do not include any harmful substances in the foodstuffs and drugs

- public health act which ensures that public business premises/ buildings are hygienic and adhere to safety standards

- rent and tribunal act which protects tenants against hike of rent without justifications

- trade description act/sale of goods act which ensures producers indicate genuine contents of the product to avoid misleading buyers

- hire purchase act which protects consumers against unfair repossession of goods

- anti-counterfeit act which protects consumers from being sold goods that are not genuine

- transport licensing act which protects consumers from being ferried in unroadworthy vehicles and incompetent personnel

- Explain five types of direct taxes that the government may use to collect revenue from individuals and companies (10 marks)

- Personal income tax (PAYE) -this is a tax levied on income of individuals such as salaries and wages

- Corporation tax/corporate tax-this is tax levied on the profits made by companies/businesses

- Capital transfer tax/ gift tax -this is tax levied on value of property transferred from one person to another as a gift

- Capital gains tax-this is tax charged when an asset is sold at a price higher than the book value

- Stamp duty-this is tax charged on transfer of land from one person to another after sale

- Estate/death duty-this is tax charged when property of dead person is transferred to another person/inheritor

- Wealth tax-this is tax levied on personal wealth that goes beyond certain limit

- Withholding tax-this is tax levied on savings such as pensions and dividends held by individuals

- Residential rental income-this is tax charged on rents collected by landlords and landladies

- Property tax/land rates-tax levied by county governments on improvement of land or building owners in the towns.

NB: The student must mention the word tax/duty for them to score

- Explain five government-initiated methods of consumer protection (10marks)

-

- Explain five clauses that must be specified in Memorandum of Association of a public limited company (10 marks)

- Name clause-states the name of the company which must end with the name limited/Ltd the name should be unique

- The objects clause-states the objectives/activities which the company is registered to do

- Situation clause-states the physical location and addresses of the registered head office

- Liability clause-informs the members of the public that shareholders have limited liabilities

- Capital clause-states the amount of capital that the company is authorized to raise. The total share capital value of each share and the number of shares

- Declaration clause-it contains declaration by the directors (promoters) about their wish to register the company.it also contains the personal information and number of shares held by each

-

- Explain five clauses that must be specified in Memorandum of Association of a public limited company (10 marks)

-

- Discuss five causes of unfavorable balance of payment for most developing countries (10 marks)

- Reliance on primary products for export. Most developing countries mainly export primary agricultural products which fetch very low prices in international market

- Heavy importation of finished goods. Most developing countries import finished manufactured goods whose values are very high hence spending more on them

- Use of low levels of technology in production. Most developing countries rely on low levels of technology in production which compromises the quality of their exports and also lowering their value

- Too much reliance on foreign borrowing. Most developing countries finance their development projects through heavy borrowing yet such loans are repaid with heavy interests

- Prone to natural calamities. Many developing countries are easily affected by natural disasters like drought which adversely affect their production

- Preference towards foreign goods. Most consumers in developing countries prefer goods manufactured in foreign countries with the belief that they are of better quality

- Unfavorable world economic order. The developing countries have very little say in international trade forums and cannot influence the world economic order in their favor

- Explain five factors that an entrepreneur would consider when evaluating a business idea (10 marks)

- return on investment/profitability/profit margin to be earned from the investment. There should be a reasonable profit from investment in order to cover all the operational expenses and get surplus

- existing attitudes, practices and beliefs of the target market. The new product, service or business idea must be in line with the people’s attitudes practices and beliefs if it has to be accepted and hence marketed

- availability of appropriate technology. The technology to be used in producing the product or offering the service should be efficient and cost effective

- size and availability of market. There should be adequate consumers for the goods or services to be provided

- availability of an effective channel of distribution. This will ensure that the product is always available in the market so that customers buy it when they decide to

- ability of the product to satisfy the immediate need of the customers. The new product must be of tangible or felt benefit to the buyer hence making it very attractive

- the level of competition, the entrepreneur should look at the systems used by the competitors and strategize accordingly

- the payback period this should be reasonable to allow the investor break even and recover the capital invested

- the risks involved. these should be manageable AND MINIMAL TO AVOID unnecessary losses

- Discuss five causes of unfavorable balance of payment for most developing countries (10 marks)

-

- Prepare a three-column cash book duly balanced (10 marks)

- Explain five ways of making face to face communication effective (10 marks)

- Clarity of the message so as to avoid misunderstanding and ambiguity

- Use of non-verbal cues to clarify and reinforce verbal communication

- Communicating parties being close to each other to avoid shouting/not hearing

- Communicating parties to use a common language thus enhancing understanding of the information

- Making the message concise and brief to avoid unnecessary details

- good listening and being attentive so as to understand the message being passed

- Positive attitudes between the communicating parties to avoid prejudice

- Use of simple language and non technical terms to make it easy for the receiver to understand

- Having courtesy and respect between the sender and receiver to avoid hostilities

- Tone variation to break and sustain interest for the listener

- Prepare a three-column cash book duly balanced (10 marks)

-

- Explain five negative implications of a youthful population (10marks)

- There is high dependency ratio since the working population is small

- It leads to unemployment since existing job opportunities do not match the demand

- Leads to low labor supply since they may not have attained the working age or the required skills

- It diverts government resources to cater for consumption of goods for the youth hence hindering the implementation of other development projects

- It creates pressure on social amenities like schools, hospitals, recreation centers etc

- May lead to increased social evils such as crime and prostitution due to lack of jobs

- Increased rural -urban migration leading to the development of slums

- There is low savings and investment due to high expenditure on consumptions

- There is low investment leading to low production of goods and services

- Low per capita income due to high dependency ratio

- Possible political instability due to inability to control and maintain the growing population

- Prepare:

- A profit and Loss account (4 ½ marks)

- A balance sheet (5 ½ marks)

- Explain five negative implications of a youthful population (10marks)

Download Business Studies Paper 2 Questions and Answers - Wahundura Boys Mock Examination 2023.

Tap Here to Download for 50/-

Get on WhatsApp for 50/-

Why download?

- ✔ To read offline at any time.

- ✔ To Print at your convenience

- ✔ Share Easily with Friends / Students