INSTRUCTIONS TO THE CANDIDATES

- Answer any five questions.

- All questions carry equal marks.

For Examiner’s Use only:-

|

Question |

Marks |

|

1 |

|

|

2 |

|

|

3 |

|

|

4 |

|

|

5 |

|

|

6 |

|

|

TOTAL MARKS |

|

QUESTIONS

-

- Explain any five factors promoting entrepreneurship in Kenya (10 mks)

- Explain five advantages of using office machine. (10mks)

-

- Give five difference between Public Company and public corporation public company (10 mks)

- The following trial balance has extracted from the books of Bishar Retailers on 30th April, 2006.

Stock at 30th April, 2006 was shs 49,980.Dr Cr shs shs Sales 186,000 Purchases 115,560 Stock 1.5.2005 37,760 Carriage outwards 3,260 Carriage inwards 2,340 Returns 4,400 3,550 Motor expenses 6,640 Rent 4,560 Salaries and wages 24,490 General expenses 12,000 Rates 1,200 Equipment 60,000 Machinery 31,960 Trade debtors 45,770 Trade creditors 30,450 Bank 38,760 Cash 12,000 Drawings 20,500 Capital 128,440 348,440 348,440

Required;- Prepare Trading, profit and loss Account for the year ended 30th April 2006. (6marks)

- Balance as at 30th April 2006. (4mks)

-

- Discuss five reasons why a manufacturer may sell directly to consumers (10mks)

- Explain five advantages of using office machine. (10mks)

-

- Explain five factors which may influence choice of a distribution channel. (10 marks)

- State and explain five macro environments and the positive effect of each on the performance of a business (10 marks)

-

- Describe five features of good money. (10 marks)

- On 1st June 2009, MULI ENTERPRISES had cash in hand sh. 87,000 and cash at bank sh. 250,000.During the month, the following transactions took place.

June 2, Sales (cash) sh. 50,000

3, Paid salaries sh.101, 500 by cheque.

6, Received a cheque for sh. 76,800 from Mwelu after allowing her a cash discount of 4%.

12, Bought office furniture by cheque sh. 85,000

16, Settled Musau’s account of sh. 40,000 in cash, having deducted shs 800 cash discount.

18, Received a cheque for shs 150,000 in respect of cash sales.

21, Paid wages shs 24,000 in cash.

22, Withdrew shs 30,000 from bank for office use.

25, Withdrew shs 5000 cash for private use.

28, Received shs 16500 cash from Kasiva in settlement of her account less shs 660 cash discount.

June 30, Deposited all the money into bank except shs 25,000

Prepare a three column cash book and balance it off. (10marks)

-

- Explain five uses of national income statistics to an economy. (10mks)

- With the aid of an appropriate labelled diagram, explain four circumstances under which supply curve may shift to the right hand side. (10 marks)

MARKING SCHEME

-

- Factors promoting entrepreneurship in Kenya

- Favorable government policies

- The strength of financial institutions in Kenya

- Infrastructure

- Availability of market for goods and services

- The level and type of education and training

- Presence of role models

- Security and political stability in the country

- The social-cultural practices of the people

- Legal provision or lows that may not enhance entrepreneurship (5x2=10mks)

- Explain five advantages of using office machine. (10mks)

- Labor saving reducing wages bill

- Reduce the firms labour- related problems e.g “unrest”

- Work produced is of high quality and more presentable

- Output is standardized

- Speeds up the rate of production

- Helps to improve the level of accuracy

- Enhance s the image of the company

- Lowers the cost of production

- Factors promoting entrepreneurship in Kenya

-

- Give five difference between Public Company and public corporation

Public Company Public Corporation They are formed by the Company Act They are formed by the Act of parliament. It is owned by shareholders i.e. ordinary shareholders Owned by the government Able to raise capital through sale of shares to the public. Capital is provided by the government. Board of directors are elected by shareholders from among themselves. Board of directors are appointed by the Government. The profit generated are distributed to shareholders as dividends It is formed to improve the services to the public - The following trial balance has extracted from the books of Bishar Retailers on 30th April, 2006.

Stock at 30th April, 2006 was shs 49,980.Dr Cr shs shs Sales 186,000 Purchases 115,560 Stock 1.5.2005 37,760 Carriage outwards 3,260 Carriage inwards 2,340 Returns 4,400 3,550 Motor expenses 6,640 Rent 4,560 Salaries and wages 24,490 General expenses 12,000 Rates 1,200 Equipment 60,000 Machinery 31,960 Trade debtors 45,770 Trade creditors 30,450 Bank 38,760 Cash 12,000 Drawings 20,500 Capital 128,440 348,440 348,440

Required;- Prepare Trading, profit and loss Account for the year ended 30th April 2006. (7marks)

- Balance as at 30th April 2006. (5marks)

BISHAR RETAIL BUSINESS

TRADING PROFIT AND LOSS A/C

FOR THE PERIOD ENDING 30TH APRIL 2006

@entry=½mark,total =7mksDr

Cr

Ksh

Ksh

Ksh

Ksh

Opening stock

37760

Sales

186000

Add purchases

115560

Less return inwards

4400

Add carriage inward

2340

Net sales

181600

117900

Less return outwards

3550

114350

COGAS

152110

Less closing stock

49980

Cost of goods sold

102130

Gross profit c/d

79470

181600

181600

Gross profit b/d

79470

Carriage outwards

3260

Motor expenses

6640

Rent

4560

Salary & wages

24470

General expenses

12000

Rates

1200

Net profit c/s

27320

79470

79470

Net profit b/d

27320

- Balance sheet as at the date. (5mks)

BISHAR RETAIL BUSINESS

BALANCE SHEET

AS AT 30TH APRIL 2006

Ksh

Ksh

Ksh

Fixed Assets

Capital + Liabilities

Equipment

6000

Capital

128440

Machinery

24000

30000

Add net profit

27320

Current Assets

Less drawings

20500

Stock

49980

135260

trade debtors

45770

Current Liabilities

Bank

38760

Trade creditors

30450

Cash

1200

135710

165,710 165,710

- Give five difference between Public Company and public corporation

-

- Discuss five reasons why a manufacturer may sell directly to consumers. (10marks)

- Where the customers are concentrated in one place

- Customers are close by/Near the market

- Requirement by government policy as the government may force a particular manufacturer to sell their products direct to consumers.

- If products are produced only on order hence no need for intermediaries

- Where Production follows customer specification

- Manufacturer has adequate financial resources to fund the process of distribution

- If the product is perishable/Fragile thus need for less handling

- Explain five advantages of using office machine. (10mks)

Advantages of using office machine- Labor saving reducing wages bill

- Reduce the firms labour- related problems e.g “unrest”

- Work produced is of high quality and more presentable

- Output is standardized

- Speeds up the rate of production

- Helps to improve the level of accuracy

- Enhance s the image of the company

- Lowers the cost of production

- Discuss five reasons why a manufacturer may sell directly to consumers. (10marks)

-

- Explain five factors which may influence choice of a distribution channel. (10 marks) .

- Number of potential customers

- Where customers are few, the manufacturer may use its own sales force/large number of customers may use intermediaries.

- Geographical concentration of the market, where the market is centralized in a few geographical areas, direct distribution is okay/less concentrated market may use intermediaries.

- Order size

- Economical to sell directly for customers who buy in large quantities.

- Use intermediaries for customers who buy in small quantities.

- Unit value of the product.

- Products of high value can be distributed directly due to high risks.

- Low value can use intermediaries.

- Perishability of the product.

- Perishable goods distributed through short fast channel to avoid spoilage.

- Technical nature of the product.

- Good of highly technical nature sold to customers in order to give pre-sale and after sales service.

- Financial resources

- A producer who is financially strong can afford to distribute directly to consumers

- The intermediaries/availability

- Different intermediaries perform different functions, hence a firm should select the channel convenient to it to ensure smooth operations.

- Competitors

- A firm wishing to have its product compete directly with that of a competitor would select a channel that the competitor uses and vice versa.

- Government policy

- Where the government requires a particular channel to be used, the producer will have no choice.

- Cost- The distribution channel to be used must be affordable/should allow the manufactures to maximize profits.

- Number of potential customers

- State and explain five macro environments and the positive effect of each on the performance of a business (10 marks)

- Economic environment (favourable): Economic situations that increase consumers’ purchasing power eg low price levels, high consumers income, low interest rates, low levels of inflation and taxes.

- Demographic environment: A high population creates a wider market and hence more sales & profits.

- Advancement in technology: High levels of know-how and efficient use of tools/equipment lead to better quality goods/services and reduced cost of production.

- Legal environment (favourable): Laws and policies made by the government should be favourable eg. Taxation, legislation, ease in licensing etc.

- Favourable political environment: Political stability leads to peace there by creating a conducive environment for business to thrive.

- Favourable cultural environment where customs values and beliefs of the society are for the product, this boosts sales and the business thrive

- Fair competition: This will enable the business cope with the competitors and remain in operation.

- Physical environment (ideal or favourable): Relief, climate, infrastructure, electricity etc when ideal enables the business operate efficiently.

- Explain five factors which may influence choice of a distribution channel. (10 marks) .

-

- Describe five features of good money. (10 marks)

- Five characteristics of good money

- Acceptability: Must be acceptable to everyone for it to be used as a medium of exchange.

- Divisibility: Should be divisible into smaller units without loss of value.

- Scarcity: Should be relatively limited in supply so as to maintain value.

- Cognizability: Should be easy to recognize genuine from fake money.

- Malleability: Should be easy to print or mint but difficult to forge.

- Homogeneity: Money of the same denomination should be uniform in quality and identical.

- Stability in value: Should be able to last for a long time without changing in value so that it maintains credibility and acceptability. If it fluctuates in value, people prefer holding wealth in form of goods.

- Portability: Should be easy and convenient to carry around.

- Durability: Should be able to last for along time without getting torn, defaced or losing shape and texture.

- On 1st June 2009, MULI ENTERPRISES had cash in hand sh. 87,000 and cash at bank sh. 250,000.During the month, the following transactions took place.

June 2, Sales (cash) sh. 50,000

3, Paid salaries sh.101, 500 by cheque.

6, Received a cheque for sh. 76,800 from Mwelu after allowing her a cash discount of 4%.

12, Bought office furniture by cheque sh. 85,000

16, Settled Musau’s account of sh. 40,000 in cash, having deducted shs 800 cash discount.

18, Received a cheque for shs 150,000 in respect of cash sales.

21, Paid wages shs 24,000 in cash.

22, Withdrew shs 30,000 from bank for office use.

25, Withdrew shs 5000 cash for private use.

28, Received shs 16500 cash from Kasiva in settlement of her account less shs 660 cash discount.

June 30, Deposited all the money into bank except shs 25,000

Prepare a three column cash book and balance it off. (10marks)

MULI ENTERPRISES

THREE COLUMN CASH BOOK

20 x1/2 = 10marksDate

Details

Disc. Allowed

Cash

Bank

Date

Details

Disc. Received

Cash

Bank

2009 1/6

Bal b/d

87,000√

250,000√

2009 2/6

Salaries

101,500√

2/6

Sales

50,000√

12/6

Furniture

6/6

Mwelu

3,200√

76,800

16/6

Musau

800

39,200√

18/6

Sales

150,000

21/6

Wages

2,400√

22/6

Bank

30,000√

22/6

Cash

30,000√

28/6

Kasiva

660√

16,500√

25/6

Drawings

5000√

30/6

Cash

c

90300√

30/6

Bank

c

90,300√

30/6

Bal c/d

25,000√

350,600√

3,860

183,500

567,100

800

183,500√

567,100√

- Describe five features of good money. (10 marks)

-

- Explain five uses of national income statistics to an economy. (10 marks)

Five uses of National income statistics- They are used to measure the overall economic growth of a country.

- They can be used to compare the standard of living between countries and also compare standards of living of citizens in a country at different times.

- They can be used for planning purposes by the government to ensure proper allocation of resources.

- Entrepreneurs may use the national income statistics to make investment decisions by observing consumption patterns.

- Statistics show the contribution of various sectors and regions to the national income.

(Any 5 well explained @ 2marks = 10marks)

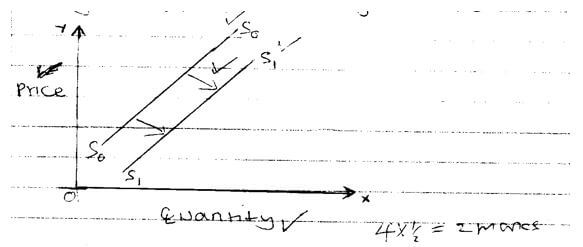

- With the aid of an appropriate labelled diagram, explain four circumstances under which supply curve may shift to the right hand side. (10 marks)

Circumstances under which supply curve may shift to the right hand side.- Improved technology

- Increased supply of inputs

- Decreased cost of production

- Entry of new firms to industry

- Increased government subsidy’s

- Decreased taxation of input

- (Any 4 well explained @ 2marks = 8marks)

- Explain five uses of national income statistics to an economy. (10 marks)

Download Business Studies Paper 2 Questions and Answers - Form 4 Term 2 Opener Exams 2022.

Tap Here to Download for 50/-

Get on WhatsApp for 50/-

Why download?

- ✔ To read offline at any time.

- ✔ To Print at your convenience

- ✔ Share Easily with Friends / Students